how to lower property taxes in georgia

The assessed value of any property can increase by no more than 2 percent per year. If the ownership of the property changes the.

Georgia Property Tax Calculator Smartasset

Local state and federal government websites often end in gov.

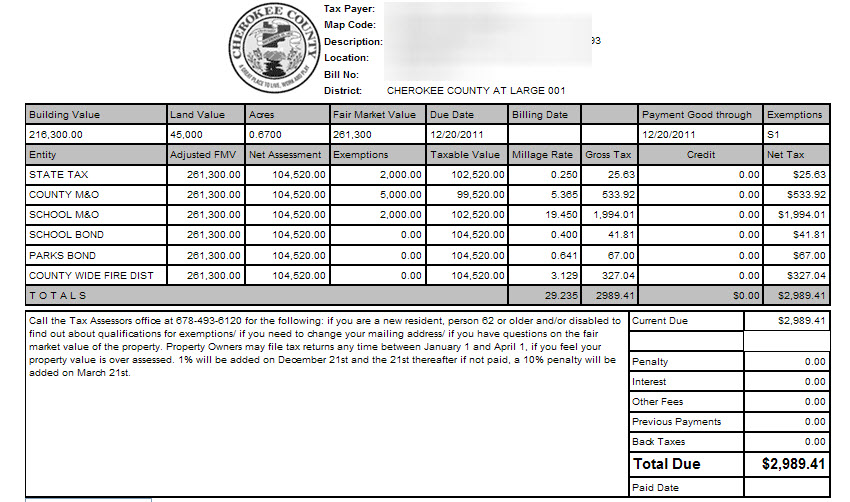

. Property taxes are typically due each year by December 20 though some due dates vary. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. People who are 65 or older can get a 4000 exemption.

If a property owner fails to file a timely appeal the owners only recourse is to wait until the following year when the property owner may file a property tax return requesting that the. File Your Property Tax Appeal. Wondering how to lower your property taxes.

How much can property taxes increase per year in Georgia. If you think your property. Your local tax collectors office sends you your property tax bill which is based on this assessment.

How are ga property taxes calculated. All property in Georgia is taxed at an assessment rate of 40 of its full market value. Find the Most Recent Comps.

Verify the property tax record data on your home. Property taxes are paid annually in the county where the property is located. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own.

Georgia Property Tax Relief Inc. Look at Your Annual Notice of Assessment. 48-5-7 Property is assessed at the county level by the Board of Tax.

As a rental property owner if your expenses for the property exceed your income from the property you may deduct that loss from your taxable income. What are property taxes based on in Georgia. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results. There is no minimum or maximum amount to pay on your property in Georgia to pay real property taxes. Apply for Homestead exemptions.

Individuals 65 Years of Age and Older. DRIVES e-Services kiosk tag. DRIVES System Maintenance - Saturday 917.

Exemptions such as a homestead exemption. If your income non. How To Lower Property Taxes In Georgia.

The amount for 2019 is 85645The value of the property in excess of this exemption remains taxable. Exemptions such as a homestead exemption. DRIVES will be unavailable on Saturday September 17 2022 from 130 pm until 1030 pm for scheduled maintenance.

Whether you have a 70000 or 7000000 house you will owe real. One way is to appeal your property tax assessment. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

This exemption is extended to the unremarried surviving spouse or minor children as. Look at Your Annual Notice of Assessment. There are a few ways to lower property taxes in Georgia.

Get Ready to Wait. All property in Georgia is taxed at an assessment rate of 40 of its full market value. 23 AprTips for Lowering your Property Tax Bill in 2020.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. In order to come up with your tax bill your tax office multiplies the tax rate by.

-resized-600.jpg)

Get Lower Property Taxes In Georgia

Dekalb County Ga Property Tax Calculator Smartasset

Tax Comparison Florida Verses Georgia

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Tax Appeals When How Why To Submit Plus A Sample Letter

America S New Great Migration In Search Of Lower Property Taxes Marketwatch

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Exemptions To Property Taxes Pickens County Georgia Government

Georgia Lawmakers Ask Mayor Miller To Lower Property Taxes Early Correct Success

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Cherokee County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

State Tax Levels In The United States Wikipedia

Property Tax Appeal Blog Georgia Property Tax Assessment

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group