taxing unrealized gains explained

Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. To understand how this worksand whether.

Crypto Tax Unrealized Gains Explained Koinly

The big deal is this.

. Unrealized gains and losses aka paper gainslosses are the amount you are either up or down on the securities youve purchased but not yet sold. Income is subject to a concept called constructive. This is a very big deal.

To calculate unrealized gains or losses you can use the following formula. The Congress has given the Internal Revenue Service the authority to tax income at certain rates. Taxing unrealized gains will also eventually find its way to the common folk.

In a nutshell its a 20 tax on the unrealized capital gains hang on to that thought of American households worth at least 100 million. If the value drops to See more. The same was true of the new income tax in 1913.

A capital gain is when you own a thing that goes up in value and a loss is when it goes down. It will then crush the poor and middle class by making it increasingly difficult to own and maintain. Understanding Blockchain and Bitcoin httpsbitly33hbAi5 Subscribe to our channel here so you do not miss our DAILY VIDEOS and pr.

A realized gain is when you actually turn that into dollars by selling the thing. Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run. Basically it is the.

President Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital gains. Taxation is theft which is why in todays video I cover the problem with taxing unrealized gains. Current FMV - FMV at time of purchase Unrealized GainLoss.

The Tax would Empower The IRS In order to enforce this tax the IRS would have to be given vast new powers to value. 10 Problems with Taxing Unrealized Gains 1. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

A tax on realized capital gains avoids those two problems once an asset is sold the true value is determined and the seller will have money from the sale to pay the tax bill. Now the problem with taxing unrealized gains is they litera. They only exist on paper.

How to calculate unrealized gains and losses. An unrealized gain is a type of profit that an investor company or individual is yet to receive but is expected to make in the future from the sale of an asset. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain.

If given the power to tax unrealized gains expect the feds to expand the tax to ordinary people.

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Crypto Tax Unrealized Gains Explained Koinly

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Here S How Janet Yellen S Proposed Tax On Unrealised Capital Gains May Work Business Insider India

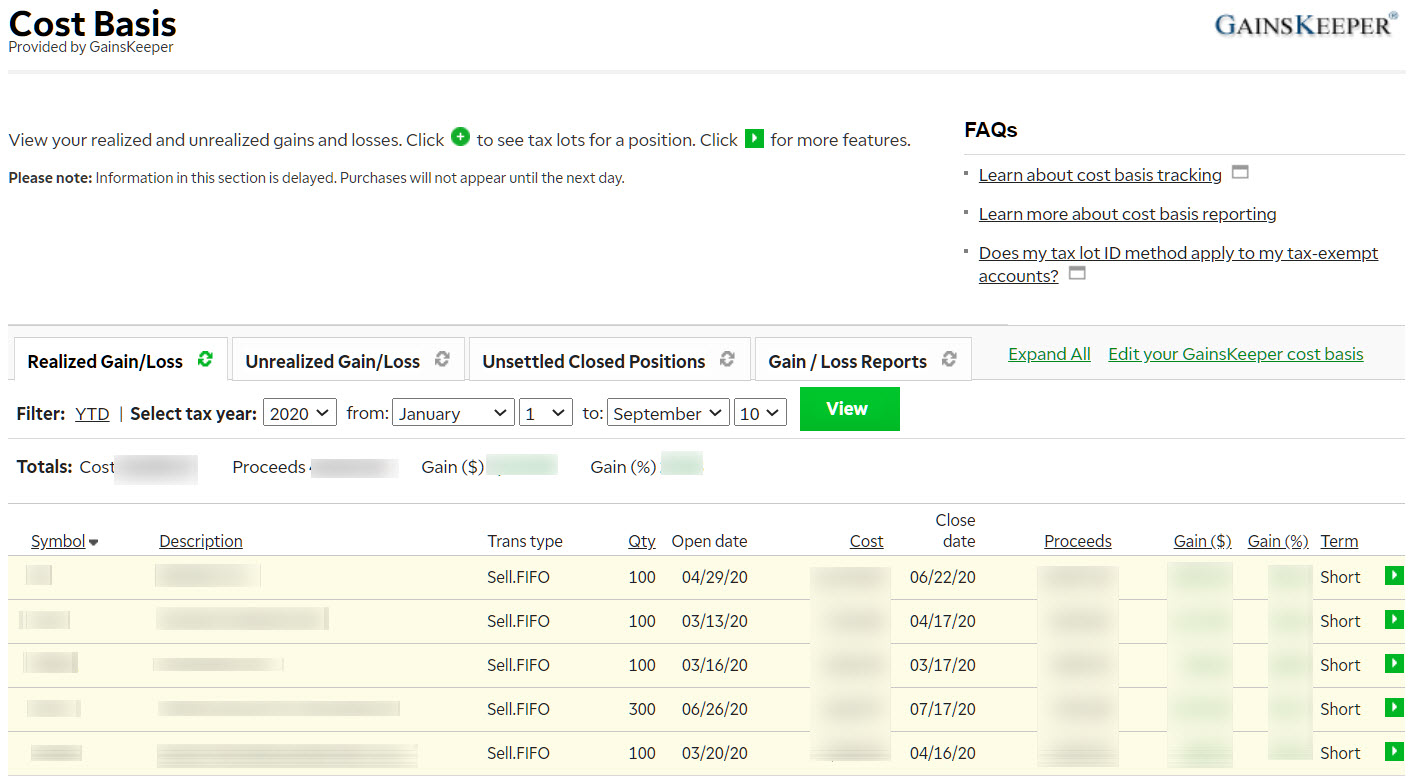

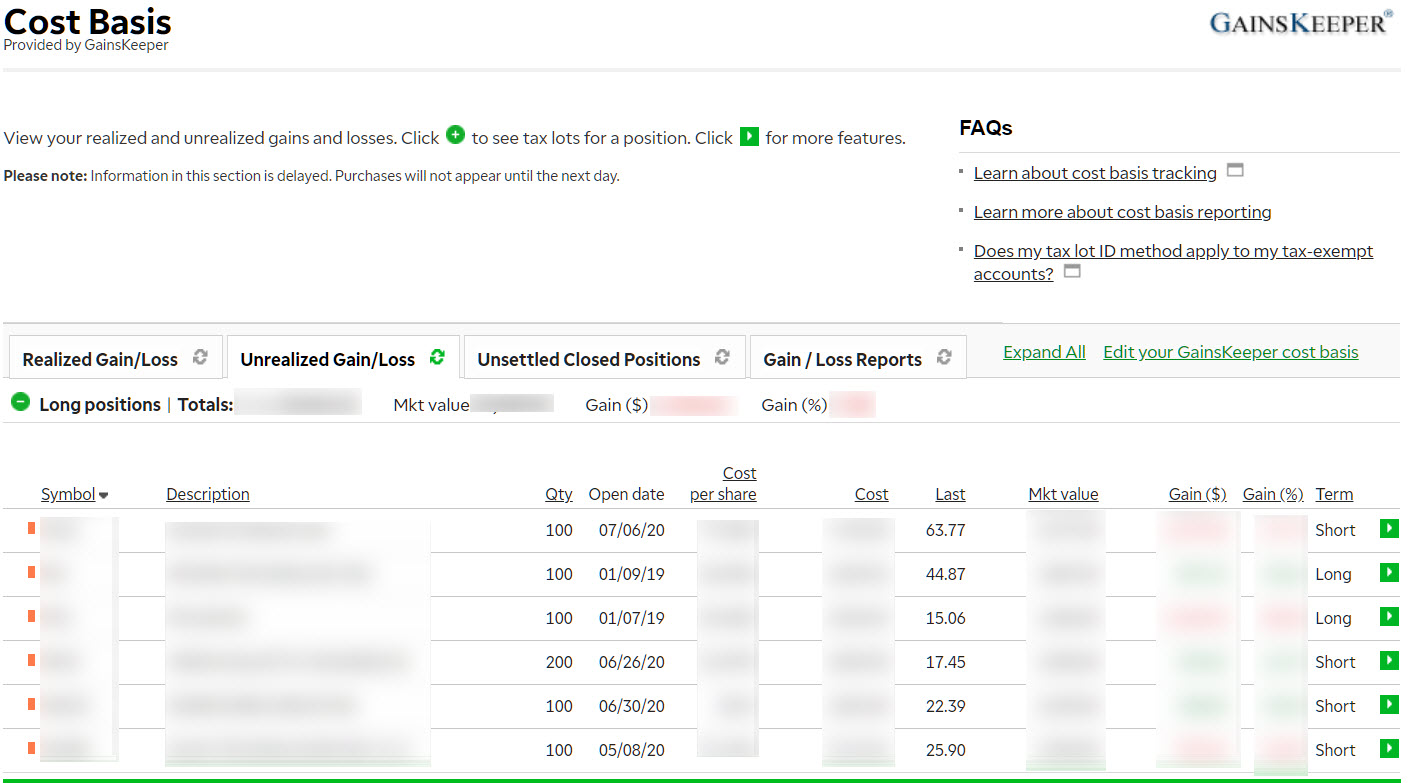

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Understanding Crypto Taxes Coinbase

Unrealized Capital Gains Tax Explained

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Capital Gains Tax In The United States Wikipedia

Capital Gain Formula And Tax Rate Calculation 2022

Capital Gains Tax Definition And How To Calculate It Pointcard

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Elon Musk S Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin Economics Bitcoin News

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape